In this post I’ll go through an in-depth analysis of Tally, a SaaS for creating forms. Wait till you reach the end of the post as I’m introducing a new section called “Fast growing SaaS“, where in every issue, a new SaaS will be featured.

Starting with Tally:

We often think of startups or “cool SaaS products“ as something that’s novel and unique.

Why would someone start a form builder in 2020 when Jotform, Typeform, Google form and so many others already existed.

As I come across hundreds of SaaS while building microsaasdb, I find this idea of a “build something novel and unique“ as flawed- it works in TV shows/movies but in real life it’s not how you make money 90% of the time.

Tally and so many other top products in microsaasdb prove that all you need to succeed with a SaaS is an idea that solves a repeatable problem, and a big enough problem for a sizeable chunk of population.

If the same solution is working monetarily for a different niche, it’s already proven that it’s a big enough and repeatable problem. All you’re left to do is find a new niche.

The reason a form builder worked even in 2020, when hundreds of others already existed, was precisely because they were able to find a new niche.

Tally’s niche was indiehackers, small businesses and early startups who don’t have big budget for form building.

It’s a typical bootstrapper success story- imitate a giant, make it simple to use and then turn the business model against the giant (more on this later).

This review sums up everything Tally stands for

In its second year (2021) tally grew by 36 times in MRR. It almost doubled MRR every single month.

This was made possible by following:

An arduous feedback gathering process

A very small team of 2 with clear division of work- one person for code and another for marketing and customer support

A business model built specifically for a niche

Keeping the marketing cost near zero

Maintaining a solid usage statistics

Let’s double-click on each of these bullets-

Feedback gathering- it’s the most crucial step that can make or break a product-most entrepreneurs struggle here because they don’t know where to start, whom to ask, how to ask.

But at times instead of over analyzing the steps we just need to start. Tally took a brute force approach. They cold outreached to creators, Indie Hackers, and startup founders, who might be interested in a simple, easy-to-use, low-cost/free form builder.

They scanned Product Hunt and Twitter and made lists of hundreds of prospects and started doing cold outreach, asking for their feedback.

This approach has a very small response rate but you only need a handful of people to validate the initial problem and solution.

The Team- the team at Tally is a husband wife couple that keeps their cost low and attrition even lower. Not an ideal scenario for most startups but it tells you how important it is to divide and conquer to find a balance between engineering and marketing.

Business Model- this is something that was the biggest differentiator for Tally. Most founders blindly go for their pricing and business model but that’s bad for motivation because it’s the one thing about your business that’s the most difficult to change.

There are so many things associated with your pricing and business model that getting a single piece wrong can tilt the entire balance against you.

Your pricing and business model affects your free to trial conversions, reviews, advantage over competitors, user retention and most importantly your MRR.

Plus there is this whole paraphernalia of billing, refunds, invoices, payment methods, discount strategies, taxes etc. around your business model that ignoring it can bite you back at a later point of time.

That doesn’t mean you should start a pricing war by lowering your price. Lowering price to gain customers almost never works in saas as you’ll soon find it demotivating to continue with support, building the product and bearing database costs with a thin margin or even a loss.

Tally’s business model was great because it balanced usage statistics with business model and pricing.

Two important pieces of usage statistics for a product like forms are: 1. number of forms created 2. forms submitted

Tally saw 40 submissions per form in 2021 for an average of 1.5 forms created per user.

What does it tell us about usage?

Many creators were building more than 1 form → they were coming back to the product because they liked it → this is a strong reason for any business to apply freemium as a business model because users have a repeatable use case.

40 submissions per form means users were benefitting from form creation- it means users can see the value in creating the forms which will encourage them to eventually pay for the product

These usage statistics show that Tally faired well on both counts of use statistics-

Recurring usage by creators

Value created for their users

With that in mind, if we now analyze their generous free tier it helps us understand the flywheel effect:

For free users, forms will always show ‘Built with Tally’ which is an automatic marketing tool for products like forms, landing page builders, email management tools, chatbots etc. For every single free form, another 40 people will see the Tally brand, which will automatically create a sales pipeline for Tally.

About 3% of free users upgrade to Tally Pro, which is how they make money. It’s not great for many software products but for a form builder, where storage+hosting costs can be kept low, it’s a win-win proposition.

Turning the business model against a giant

Typically, if there’s a giant already operating in your category, it’s difficult to compete with a free tier. Simply because you can’t offer free things to outcompete someone with deep pockets.

But that also depends on industry and how well you can manage your costs.

If you are savvy enough to find a niche that the giant has ignored, either due to its sales driven process (which means they can only justify customer acquisition above a certain price point) or focus on mid-size or large businesses, it’s the ideal scenario to apply a generous pricing plan with free customer acquisition tactic to turn the table on the giant in that niche.

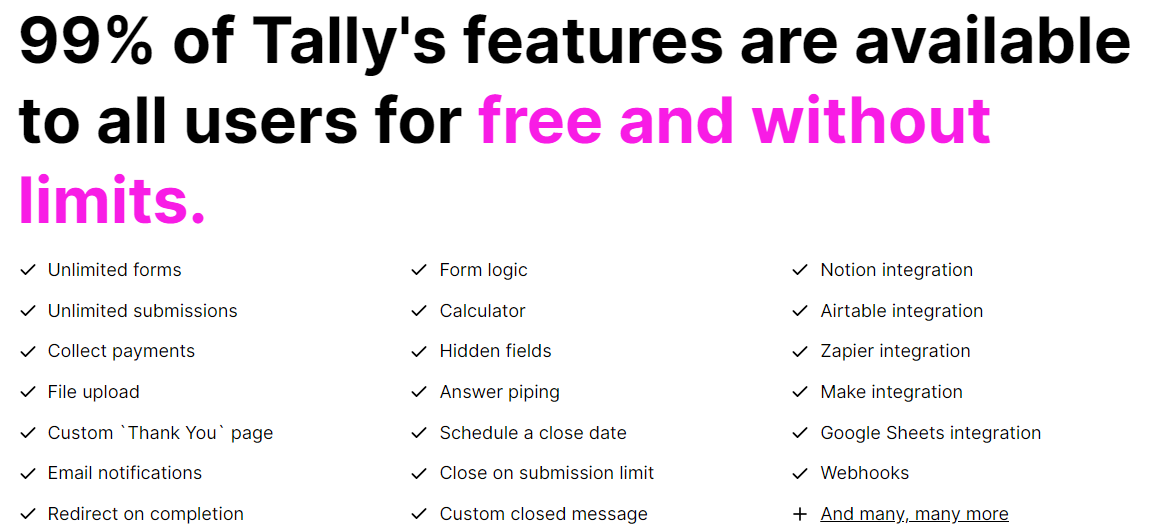

Here’s a snapshot from Tally’s pricing that’ll make you think that they are offering everything for free. But this type of pricing model is quite popular among bootstrapped products in very competitive markets where

usage is very high/frquent

Free tiers lead to automatic marketing to bring in new users (I’ll demonstrate this point with more examples in later issues but feel free to reply if you have any questions)

Costs per user minimal

Giants focus only on bigger players in the market

Tally typically charge for features like- collaboration, no-branding, email notification and partial submissions

The paid features are carefully crafted to benefit businesses that are one step ahead in the usage curve. Collaboration is typically required for businesses with a dedicated marketing team and it’s complimented by no-branding, and other advanced features. While Tally can make money from a small percentage of such users, it can afford to spread the word via individual users who are using it for free.

Marketing- As mentioned above, a large part of Tally’s marketing was from ‘Built with Tally’ feature. Another part was using a community where one founder interacted with users via Slack to receive feature requests, interact about user issues and made the customers feel special compared to large competitors who are difficult to reach for individual creators and small businesses.

Usage Stats- in the above sections we’ve already talked about metrics like forms/users and submissions/form. But in order to assess the true potential of a business we must consider how it retains its users.

An interesting fact that I noticed about Tally was that after its stunning 2021 show, it was still growing both MRR and total users at 17% month-over-month in 2022.

That indicates a very low attrition rate or an attrition rate negated by more user acquisition and in Tally’s case user acquisition was free.

Tally was spending $0 on paid marketing.

In most cases it is attrition that ruins consumer SaaS but in Tally’s case that threat was not apparent.

The likely reasons for low attrition are:

A sense of community that makes users more likely to stick around

A product that’s so easy to use that people avoid switching that might involve a significant learning curve

integrations even for free tiers that make users cost-to-swicth much higher as they’ll have to rebuild those integrations from scratch.

Risks in Tally’s business:

Finally, let’s look into the risks faced by a product like Tally. The biggest risk that I’ve seen for SaaS in the range of $10k to $100k MRR is hostile takeover or being crushed by an aggressive pricing tier by a competitor that wants to enter its niche.

As I mentioned earlier, by reaching $10k in MRR they have proven the existence of the niche. If its proved to be big enough for a VC-funded player to enter (depending on how fast the niche is growing) this threat will become more apparent.

Sources: https://blog.tally.so/

Finally, the much awaited fastest growing SaaS section

This week’s fastest growing SaaS is: SiteGPT.ai

This product grew to $10k MRR within a month after a viral tweet from its founder.

The product was just MVP when he launched it, and founder had to proactively engage with users and had to fix a lot of bugs every day to make it work.

I’ll keep an eye on this product and dissect its success in more detail if there’s enough interest from readers.

Here’s the link to tweet and here’s the link to SiteGPT.

Great analysis 👍👍